About Pearson Creek Capital Management

Pearson Creek is a Chicago-based, SEC registered investment advisor with traditional and alternative assets under management of $220 million. We design, implement and manage long-term investment plans for our clients, which range from individuals and families to large institutions.

Pearson Creek is equally qualified managing conservative investment portfolios as well as more complicated investment programs using alternative assets or financing. While our knowledge of investment alternatives is very broad, we are passionately client-centric. Clients rely on Pearson Creek for exceptional service, transparency and trust. We take our role as an investment fiduciary very seriously.

Investment Fiduciary

Pearson Creek enters into a fiduciary relationship with its clients. We are a fee-based investment advisor. We do not accept payments from groups seeking to sell investment products to our clients. Pearson Creek embraces its fiduciary relationship with clients, and believes it leads to stronger relationships and superior investment outcomes.

Investment Management

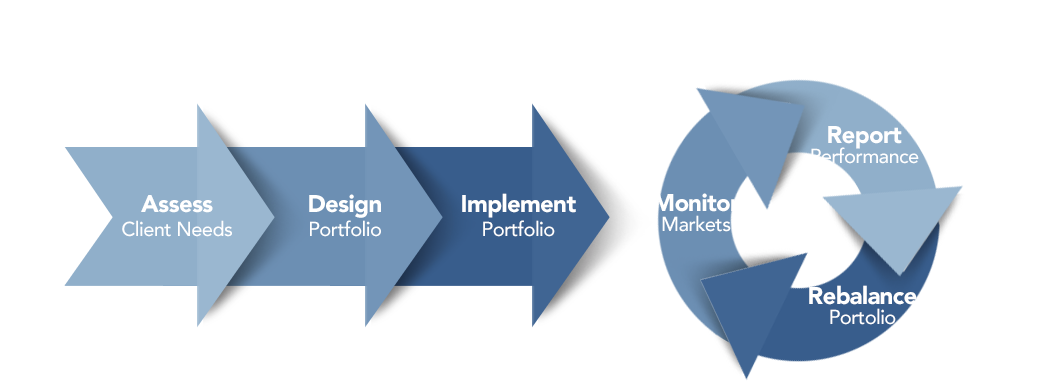

Pearson Creek delivers investment solutions to some of the world’s most demanding clients. We begin an engagement by developing a thorough understanding of our client’s return goals, risk tolerance, liquidity needs, and investment horizon. We then assemble a portfolio customized to meet the client’s needs, and we manage the portfolio over time.

Alternative Assets

Our founder has experience managing billions of dollars of alternative assets including hedge funds, private equity funds, private real estate and infrastructure investments. Alternative assets offer advantages and disadvantages versus traditional assets. In cases where alternative assets make sense for our clients, Pearson Creek can deliver solutions.